free cash flow yield private equity

Web How to Calculate Free Cash Flow Conversion. Deals Industry Overview Top Firms Interview Questions Modeling Tests Salaries and Exit Opportunities.

Why And How To Implement A High Free Cash Flow Yield Investment Strategy Quant Investing

Caseys Cash for Classrooms Grant Program Now Open for Submissions UnitedHealthcares 2023 Medicare Plans Add New Benefits Simplicity for Consumers Get RSS Feed More News.

. Web Photo by Viacheslav Bublyk on Unsplash. Experts Predict a Domino Effect to Push Home Equity Rates Up After the Fed Meeting. Infrastructure assets usually yield high cash flows during the holding period.

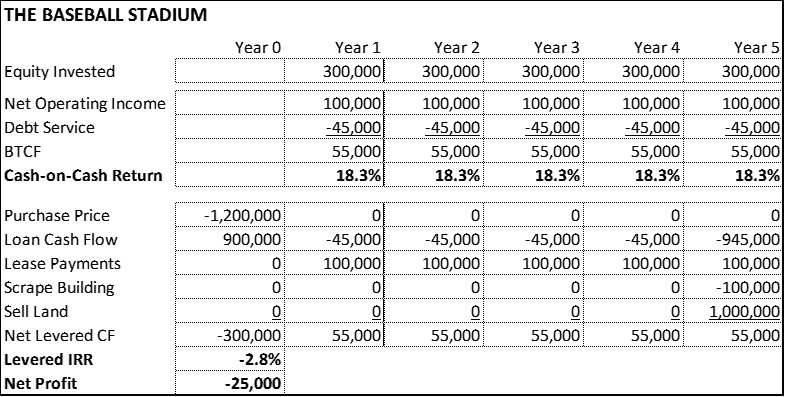

Best High-Yield Savings Accounts. In Years 4 and 5 Cash Flow to Equity is approximately 150K 7 million 2 10K. Web Valuation using discounted cash flows DCF valuation is a method of estimating the current value of a company based on projected future cash flows adjusted for the time value of money.

Assuming no capital costs Cash Flow to Equity in Years 1 to 3 500K 7 million 5 150K. The RBA also reiterated that the conditions required for a cash rate hike are not expected to be met until 2024 at the earliest. High Free Cash Flow Stocks to Buy in 2022 10.

Web On June 1 2021 the RBA kept the cash rate target 01 percent and the 3-year government bond yield target 01 percent as well as the parameters of the Term Funding Facility unchanged. Calculating the FCF conversion ratio. 80 billion Free cash flow yield.

It could be based on either Cash Flow to Equity or Unlevered Free Cash Flows. The negative cash flow for MPW was 1062. Web LFCF yield is calculated as levered free cash flow divided by the value of equity.

Web This cash-flow hierarchy is modeled as a waterfall In a typical project finance waterfall the starting line is CFADS from which debt service is paid out with the cash-flows remaining split in the hierarchy to other cash uses for example. 67 Target TGT opens in new tab 22509 CEO Brian Cornell received. NVIDIA Corporation NASDAQNVDA Number of Hedge Fund Holders.

Free Cash Flow 275 million. Explanation of Free Cash Flow Formula. Web A collateralized debt obligation CDO is a type of structured asset-backed security ABS.

Like other private label securities backed by assets a CDO can be thought of as a promise to pay investors in a. Web Infrastructure Private Equity. Then all are summed such that NPV is the sum of all terms.

Web Free Cash Flow 550 million 100 million 175 million. Cash inflow cash outflow at time t. Finance activities take place in financial systems at various scopes thus the field can be.

Web Fundamental analysis is a method of evaluating a security in an attempt to measure its intrinsic value by examining related economic financial and other qualitative and quantitative factors. The free cash flow conversion rate measures a companys efficiency at turning its profits into free cash flow from its core operations. Web Cash flow is the net amount of cash and cash-equivalents moving into and out of a business.

Web The NOI each year is 10 million 5 500K and you use 7 million of Debt and 3 million of Equity. 1117 billion Free cash flow trailing twelve months TTM. Originally developed as instruments for the corporate debt markets after 2002 CDOs became vehicles for refinancing mortgage-backed securities MBS.

Web Global oil majors continue to slash costs and generate free cash flow thats cash not needed in operations. Web MPW received a positive cash flow of 344016 million from operating activities and 534128 million positive cash flow from investing activities. Web The tech titans free cash flow was reported at a stellar 208 billion good enough for a solid 94 uptick from year-ago quarterly free cash flow of 19 billion.

The cash flows are made up of those within the explicit forecast period together with a continuing or terminal value that represents the cash flow stream after the forecast. Free Cash Flow TTM. The formula for net cash flow can be derived by using the following steps.

In an efficient market higher levels of credit risk will be associated. Debt Service Reserve Account DSRA Major Maintenance Reserve Account MMRA. Web In corporate finance free cash flow FCF or free cash flow to firm FCFF is the amount by which a businesss operating cash flow exceeds its working capital needs and expenditures on fixed assets known as capital expenditures.

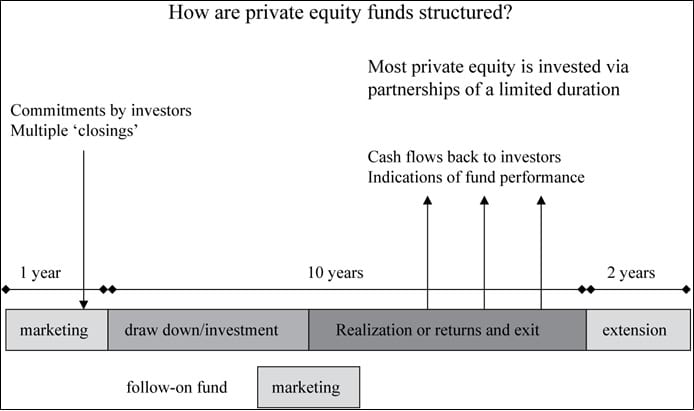

Web Private equity PE typically refers to investment funds generally organized as limited partnerships that buy and restructure companiesMore formally private equity is a type of equity and one of the asset classes consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange. Zacks Investment Research. Free Cash Flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and working capital for the year.

Web Read the latest business news and analytics including healthcare real estate manufacturing government sports and more from Crains Chicago Business. Web Finance is the study and discipline of money currency and capital assetsIt is related to but not synonymous with economics the study of production distribution and consumption of money assets goods and services the discipline of financial economics bridges the two. Hence the Free Cash Flow for the year is 275 Million.

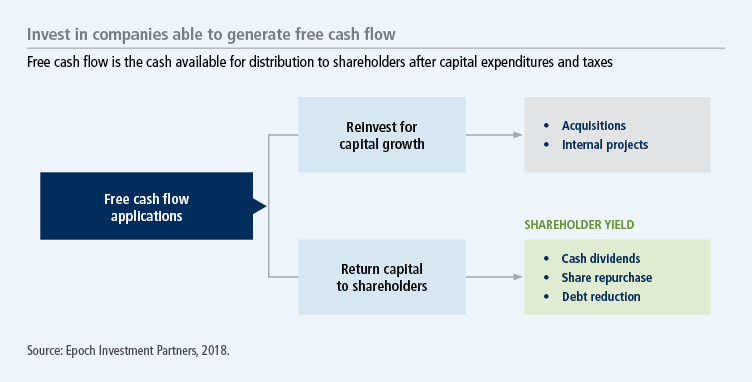

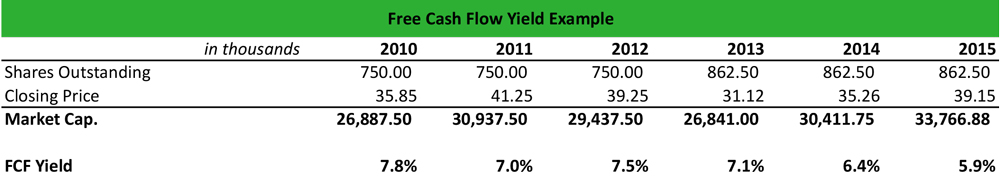

It is that portion of cash flow that can be extracted from a company and distributed to creditors and securities holders without. Free cash flow yield is meant to show investors how much free cash flow a company generates relative to the value of its sources of funds. Welcoming private capital into the industry.

Positive cash flow indicates that a companys liquid assets are increasing enabling it to settle debts. This flow of funds should improve. Where is the time of the cash flow is the discount rate ie.

In the first resort the risk is that of the lender and includes lost principal and interest disruption to cash flows and increased collection costsThe loss may be complete or partial. The return that could be earned per unit of time on an investment with similar risk is the net cash flow ie. Each cash inflowoutflow is discounted back to its present value PV.

Web Here for Schools. LFCF yield measures LFCF against the value of equity while UFCF yield measures UFCF against enterprise value. Web Cash Back Credit Cards.

Firstly determine the cash flow generated from operating activitiesIt captures the cash flow originating from the core operations of the company including cash outflow from working capital requirements and adjusts all other. Web A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments. The idea here is to compare a companys free cash flow to its EBITDA which helps us understand how much FCF diverges from EBITDA.

Growing Free Cash Flow The Key To Sustainable Equity Shareholder Yield

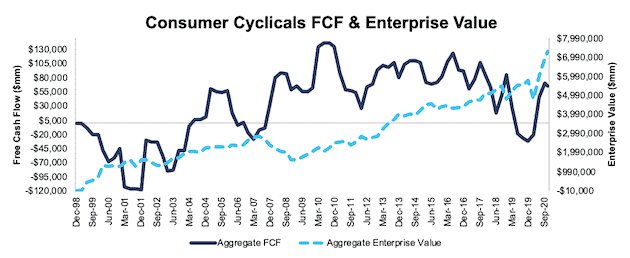

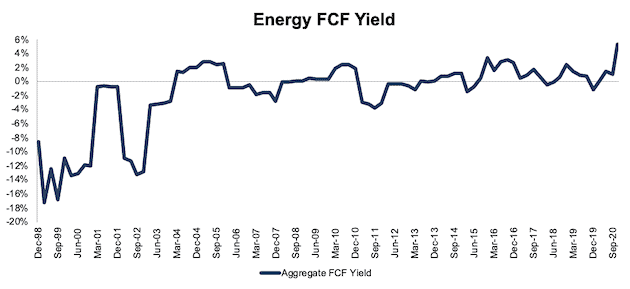

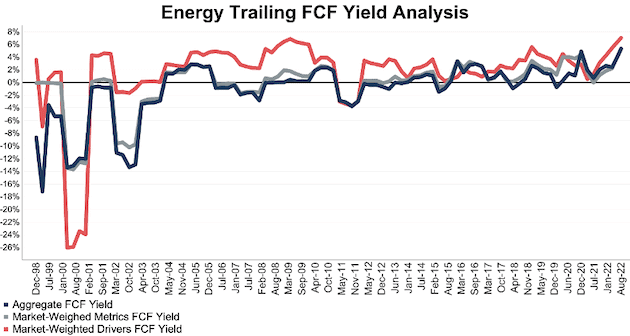

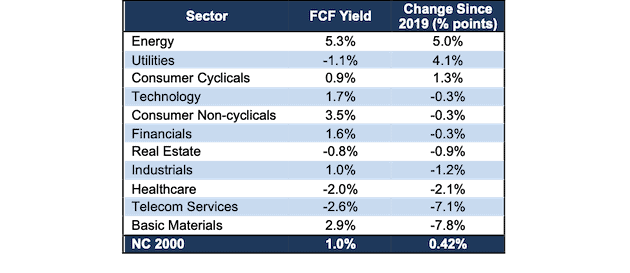

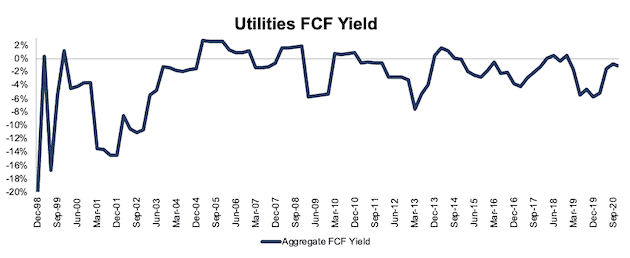

All Cap Analysis Free Cash Flow Yield Falls In 2020

Free Cash Flow Yield Explained

All Cap Analysis Free Cash Flow Yield Falls In 2020 New Constructs

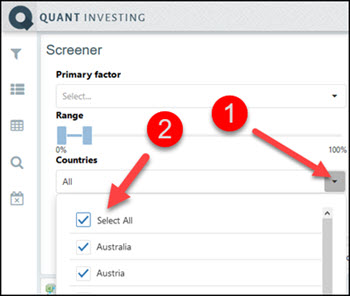

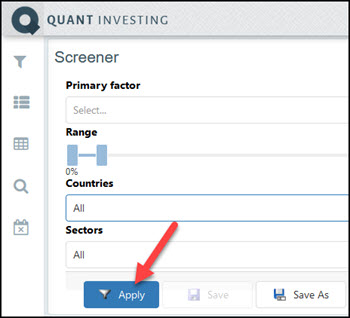

Why And How To Implement A High Free Cash Flow Yield Investment Strategy Quant Investing

All Cap Analysis Free Cash Flow Yield Falls In 2020

10 Kings Of Cash Stocks To Buy Kiplinger

Free Cash Flow Yield Formula And Calculator Step By Step

Essential Concept 86 Private Equity Fund Structures Terms Valuation And Due Diligence Ift World

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow And Shareholder Yield New Priorities For The Global Investor By William W Priest

All Cap Analysis Free Cash Flow Yield Falls In 2020 New Constructs

What Is Free Cash Flow Yield Definition Meaning Example

All Cap Index Sectors Free Cash Flow Yield Falls Through 8 12 22 Seeking Alpha

A Guide To Cash Flow Statements

Using The Cash On Cash Return In Real Estate Analysis A Cre

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

All Cap Analysis Free Cash Flow Yield Falls In 2020 New Constructs

All Cap Analysis Free Cash Flow Yield Falls In 2020 New Constructs